in residential real estate

in Tallinn with ROI from 4%

Move-in apartment

Cosy unused 2-room apartment for sale on the third floor of a five-story new house built in 2022 on…

169690€ (VAT included)

Fully furnished apartment

Cosy unused 2-room apartment for sale on the third floor of a five-story new house built in 2022 on…

173700€ (VAT included)

New furnished apartment!

Appraisal act in the amount of 187,000 euros! The price of the apartment includes kitchen furniture worth 9300 euros…

169900€ (VAT included)

New apartment in Haabersti! Garage, storage room, balcony.

Valuation act in the amount of 187,000 euros The price of the apartment includes kitchen furniture worth 9300 euros…

174900€ (VAT included)

3-bedroom flat with garage, storage room, balcony.

Appraisal report amounting to 238,000 euros!The price of the flat includes euro kitchen furniture with quality Electrolux appliances.The price…

229900€ (VAT included)

investment apartments

in Tallinn

The apartments have been assigned the energy class B. The kitchen with modern and high-quality appliances Electrolux includes a ceramic stove, dishwasher, refrigerator, and extractor. All furniture and appliances in the apartment are included in the price and remain to the new owners. New washing machine LG. Each apartment is for sale with one parking space in a covered underground parking lot or parking house. Each apartment has a basement. The apartments are fully furnished and ready for arrival / subsequent rental. The price of the facilities includes VAT.

of the ex-president of Estonia

Kersti Kaljulaid

The total volume of Kersti Kaljulaid’s portfolio is more than one million euros.

The main asset in the investment portfolio of the ex-president of Estonia is residential real estate. She and her daughter manage five apartments in Tallinn, but are looking at other European cities as prices on the local market are high.

According to Kersti Kaljulaid, she is not interested in real estate in the city center, nor does she own any old apartments. She prefers tenants with school-age children because they tend to rent for long periods.

“I’ve always found it comforting that real-estate investments are much more likely to survive all sorts of fluctuations – except maybe war. In this case, the property gives confidence that if I need resources, I can use it as collateral for a loan or sell."

Kersti Kaljulaid

in Estonia

in 2022-2023

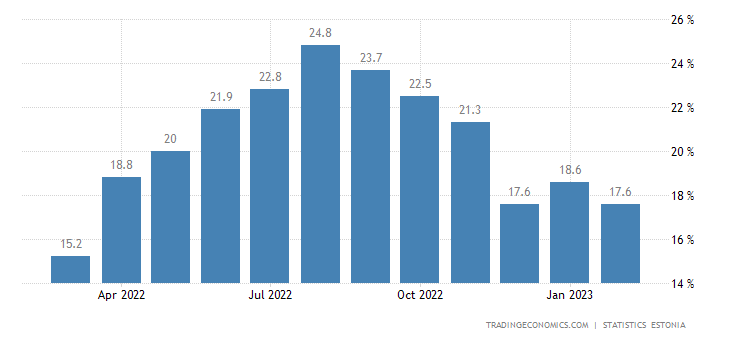

According to the authoritative website tradingeconomics.com, the inflation rate in Estonia in 2022 – 2023 did not fall below 15% and peaked (August 2023) to 25%.

Given the current situation in our country, the issue of saving funds is very acute, as the cost of money is devalued every minute. According to the Council of the European Central Bank (ECB), inflation is expected to remain extremely high for a long time, which means that the funds generated in the bank account are getting cheaper every day.

of real estate investment

In contrast to investments in funds, indices, gold, stocks, collective financing and other instruments, investment in own real estate has a number of undeniable advantages:

Value growth

In addition to receiving a monthly rent, your property will grow steadily in value from year to year

Access to your asset

You have access to your asset and can sell it at any time, if necessary to receive funds

Strategy

You can always change the investment strategy and use the purchased property yourself

Reliability

Real estate investment is the most reliable way to transfer assets to future generations

- Investment History of the 20th Century

Analysing the first half of the 20th century, it is possible to say that not always the possession of securities helped the investor to save and increase his capital. Everything depended on whether a country’s economy had won or lost world wars and crises. In countries less affected by the First and Second World Wars, equities had an annual yield of 6.5% and government bonds 1.8% of real profits. The promissory notes have also proved profitable in these regions. Such countries include Australia, Ireland, Switzerland, Canada, Sweden, the USA and the UK. Given that the last century brought world wars, hyperinflation, the two deep bear periods of equity markets are impressive.

Countries that had been defeated and devastated by the world wars of the twentieth century could not have enjoyed the same return on securities. This is Belgium: Denmark, Spain, France, Italy, Japan and Germany. Yet, at different points in time, these states have also had their ups and downs. In the 1940s, the negative return on equity was double-digit, but if you look at the whole century, the return on securities was only 4.2%.

It is worth noting that comparing the two world wars of the last century, the indicators of the fall in the share price are completely different. During World War I, securities fell by 12%, and after World War II, German stocks lost 66%. Past experience suggests that investment on the stock exchange, especially in times of instability, should be diversified. One should not hope that by buying shares of one company, its profitability will continue for years. No company has managed to maintain eternal leadership among its competitors.

In 1917, Forbes published a list of 100 major American companies. Over the next 71 years there was the Great Depression, the Second World War, the inflation of the 1970s, and the impressive post-war boom. When Forbes revised the original list in 1987, 61 companies had already ceased to exist for some reason. Of the remaining 21, the company was still in operation, but was no longer in the top 100. Only 18 remained and, with the exception of General Electric and Kodak, all of them reduced market indices. Since then, Kodak has faced serious difficulties, so General Electric is the only truly successful company to survive. In 1997, Foster and Kaplan tested the Standard & Poor’s 500 stock index since its inception 40 years ago. Only 74 companies from the original composition were still in the 500 index, and this group of companies was 20% behind the overall index.

In another study, Robert Wiggins and Tim Rufley created a database of the performance of 6,772 companies from 40 industries in the post-war period. They graded companies for excellent, sustainable performance in business, not in the stock market, lasting 10 years or more, relative to the industry in which the company worked. They found that there was no safe industry. The rate of change was faster in high-tech groups than in more conventional ones, but the rate of change increased over time in all industries. They also found that only 50% of companies had achieved a period of superiority of 10 years or more, and only half of one percent had maintained a competitive advantage for 20 years. Only three companies, American Home Products, Eli Lilly and 3M, have reached the 50-year mark.

In the last century, fixed-income investments are no better than stocks. Even in fortunate countries, they have yielded much lower returns than equities, although they have provided much less volatility.

- Why do different generations of investors choose real estate?

Real estate has been one of the preferred destinations for investment among capital owners for decades. It provides not only preservation of the condition, but also its stable growth. First, real estate is one of the most stable assets, which is poorly correlated with stock market volatility. Second, banks are ready to finance up to 90% of the cost of the facility, which means that owners do not need to withdraw money from business. Third, income is regular and usually higher than inflation, and in addition, an asset can increase significantly in just a few years. As a result, more than a third of the world’s large capital owners invest in real estate. Real estate historically ranks among the top three most popular assets for investment, and there is confidence that this will remain unchanged in the coming years.

- Transferring wealth to the next generation

The task of effective and holistic state transmission has troubled the minds of the Heinetes for generations. Another Thomas Mann at the turn of XIX-XX centuries in his novel “Buddenbrooks. The history of the death of one family” describes the history of life, rise and fall of four generations of wealthy merchants. As you know, the Buddhenbrok family failed to keep its wealth, and real life has given us more than one similar sad example.

Studies confirm that 9 out of 10 wealthy families lose their wealth by the third generation. In the second generation, typically 30% of the original capital remains, while in the third generation the figure drops to 10%.

Statistics are relentless: 2/3 families lose their inherited wealth in the second generation, and in the third, only one in ten survives, and real estate investment was the most reliable way to transfer wealth to the next generation, and the history of such family dynasties as the Rockefellers and Rothschilds is proof of that.

The issue of inheritance and transfer of wealth was not yet among the important and priority for Estonian hainetes. The period of initial capital accumulation with strong economic growth left neither the opportunity nor the will to think that nothing

eternally. But the generation of heirs has gradually grown, and today more and more the heads of households are asked how to properly transfer assets to the next generation, how to protect prosperity and increase it further and how to ensure a decent old age with double-digit inflation.

- US and Western European experience

The life-cycle saving model is a classic economic model of how assets can be used to transfer resources from working age to retirement. The basic idea is that people save their working lives by accumulating assets that they can rely on after retirement. Pensioners can support themselves with income from their assets or by selling their assets. In most Western European countries and the US, lifetime savings occur in the private sector, as workers participate in employment-based pension schemes or accumulate assets such as real estate or personal savings. The human capital of the family is the individuals who make up it. The intellectual capital of a family is the knowledge acquired through the life experience of each family member, or simply what each family member knows. The family’s financial capital is its movable and immovable assets.

- Residential property rental in Europe

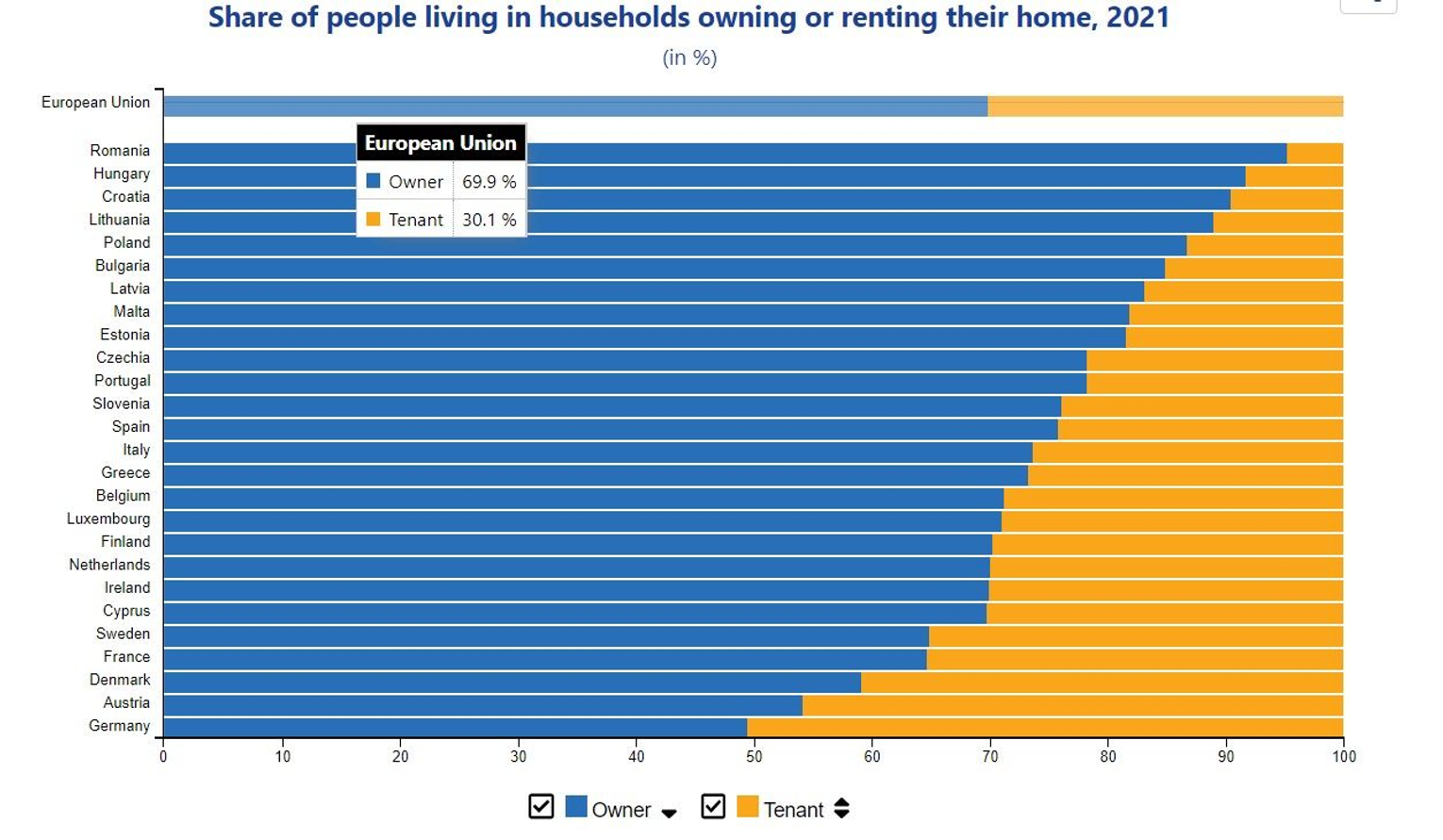

Approximately 70 per cent of the European Union population owned their own housing, and the remaining 30 per cent lived in rented housing. This is evident from the Eurostat study. At the same time, Germany became the predominant country, with 50.5% of tenants. Also live in rented houses almost 46% of Austrian residents, almost 41% – Denmark, more than 35% – in France and Sweden.

In Estonia, 61% of the population lives in apartments and 39% in houses.

In comparison with other EU countries, the majority of Estonian residents live in their own real estate and there are all the prerequisites that in the near future the situation will change and the appearance of profitable houses in Tallinn is a confirmation of this.